We Plan: Enriching Lives

We Plan: Enriching Lives

If you decide to opt for our financial planning services, we start off with a formal initiation letter to be signed along with collecting basic client data like your Income, Spending, Assets, Savings and Borrowings.

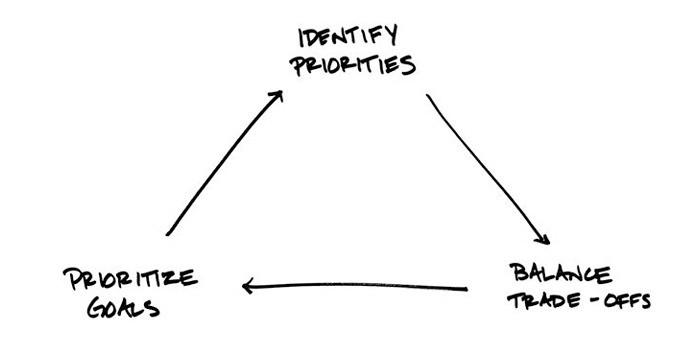

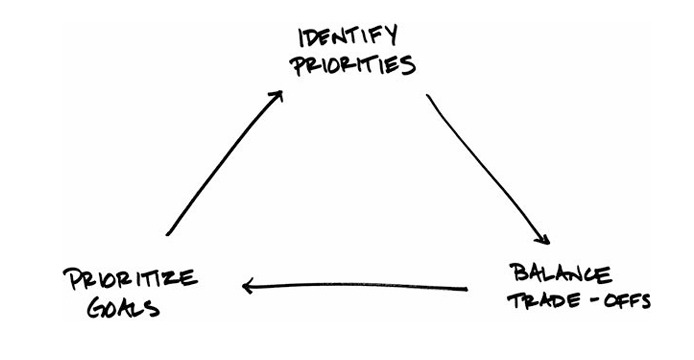

We guide you in finalizing and prioritizing your financial aspirations and prepare a net worth statement accordingly.

We guide you in maintaining Emergency Fund, managing Risk, planning the required amount of Insurance, managing loans and debt, provide planning for Retirement, Investments, Tax and Estate and other suggestions.

Through a financial plan, you get an idea so as to what amount you require to achieve financial freedom and independency so that you do not overly depend on your primary source of income.

One gets an idea about how much to run and where to draw a line and stop.

Finally, through financial planning we guide you in managing your Money, Risk ,Time and Taxes so that enough wealth may be Generated, Protected and Enjoyed forever..

We Listen: Discovery Stage

We Listen: Discovery Stage We Plan: Enriching Lives

We Plan: Enriching Lives We Built: Wealth Creation

We Built: Wealth Creation