Financial Freedom vs Financial Happiness: Why Wealth Alone Is Not Enough

“Money can buy comfort—but not contentment.”

In the world of personal finance, financial freedom is often portrayed as the ultimate destination. It is the point where an individual’s assets and income are sufficient to sustain their lifestyle without active work. However, a growing observation in modern society indicates a startling paradox:

Even after achieving financial freedom, many individuals do not experience financial happiness.

Despite having the resources to live comfortably—even luxuriously—a large number of financially successful people remain anxious, unfulfilled or directionless.

This begs the question: Why does financial freedom not always translate into financial happiness?

Defining the Two Concepts Clearly

Financial Freedom: The ability to afford one’s lifestyle without financial stress or dependence. (Outcome: Stability)

Financial Happiness: A state of emotional satisfaction and peace in relation to one’s financial life. (Outcome: Contentment)

Most financial planning models are designed to achieve freedom, but very few teach how to attain happiness from that freedom. This is where the gap lies.

Why Financial Freedom Alone Fails to Deliver Happiness

- Lack of Purpose Beyond Basic Goals

In early and middle adulthood, financial goals are relatively predictable—buy a house, fund children’s education, repay loans, save for retirement, plan family vacations. These objectives provide clarity and motivation.

However, once these milestones are achieved, many individuals are unable to define their next goal. Their financial life enters a directionless phase.

Money without purpose becomes noise. Purpose gives money meaning.

- Psychological Habits Built During the Struggle Phase Continue Even After Success

Many wealthy individuals continue to operate with a scarcity mindset, worrying more about losing money than using it meaningfully. Years of financial discipline make them risk-averse to even positive spending—such as investing in health, learning, or experiences.

- Social Comparison and the FOMO Trap

According to behavioral research, people do not evaluate wealth in absolute terms; they evaluate it relative to others.

In the era of social media:

– A ₹50 lakh car feels ordinary when someone else buys a ₹1 crore car.

– A vacation in Dubai feels small when someone posts pictures from Switzerland.

This constant comparison erodes contentment, regardless of financial success.

- Absence of Value-Based Financial Planning

Most financial plans answer “How much do I need?” but very few answer “Why do I need it?”

True financial happiness comes not from accumulating wealth but from aligning money with personal values, such as:

– Health and longevity

– Family well-being

– Learning and personal development

– Social contribution

– Spiritual or emotional growth

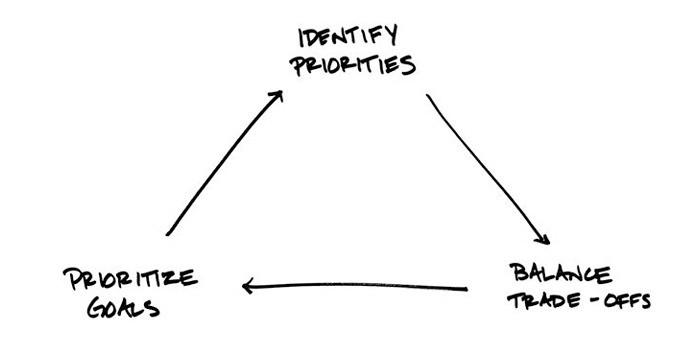

From Financial Freedom to Financial Happiness: A Framework

Step 1: Define Your Post-Freedom Priorities

Ask yourself:

– If all my expenses were taken care of, what would I wake up and do every day?

– What causes or activities bring me genuine fulfillment?

– What areas of life do I regret under-investing in?

This self-reflection is critical before wealth accumulation becomes directionless.

Step 2: Categorize Spending into Three Buckets

- Security – Basic needs & risk protection (Emergency fund, insurance, retirement)

- Growth – Progress & development (Education, health, fitness, personal skills)

- Fulfillment – Meaning & joy (Travel, hobbies, philanthropy, legacy planning)

Step 3: Replace Comparison with Gratitude Metrics

Feels fulfilled and grateful; money is a tool, not a burden.

Conclusion

Financial freedom is a milestone. Financial happiness is a mindset.

One is achieved with calculations. The other is achieved with clarity.

If wealth does not translate into peace, fulfilment, contribution or joy—it is merely stored potential, not realised value.

Financial Freedom = Capability

Financial Happiness = Contentment

The ultimate goal of financial planning should not be just to create wealthy individuals—but to create happy, purposeful and financially wise human beings.

Regards,

Trupti Wani, CFP CM

We Listen: Discovery Stage

We Listen: Discovery Stage We Plan: Enriching Lives

We Plan: Enriching Lives We Built: Wealth Creation

We Built: Wealth Creation